I’ve driven for Uber, DoorDash, and Amazon Flex for the past four years. I’ve logged over 87,000 miles across three vehicles and tested every mileage tracker app that claims to “save you thousands on taxes.”

Here’s what nobody tells you: most of these apps are battery vampires that miss 20-30% of your trips. You think you’re tracking miles automatically, but you’re actually losing deductions because the app failed to detect that 4am airport run or that quick lunch delivery.

The standard mileage deduction for 2026 is 70 cents per mile. Drive 20,000 business miles, and you’re looking at a $14,000 tax deduction. Miss 4,000 miles because your app glitched? You just lost $2,800 in deductions. That’s real money.

I’ve tested these five apps simultaneously—running multiple trackers at once to catch discrepancies. I’ve monitored battery drain with AccuBattery. I’ve compared logged miles against my car’s actual odometer. Here’s what actually works when you’re doing 10-15 deliveries per day and can’t afford to babysit your phone.

1. Stride (Best Free Option).

Price: Free (with ads)

Automatic Detection: Yes (GPS-based)

Battery Drain: Moderate (15-20% per 8-hour shift)

Accuracy: 85-90% trip detection

The Real-World Test

Stride is the app every gig worker starts with because it’s completely free. No trial period that expires. No “upgrade to unlock features.” It’s genuinely free, supported by ads and partnerships with insurance companies.

I ran Stride exclusively for two weeks while driving DoorDash (8-10 hour shifts, 15-25 deliveries per day). The app detected 87% of my trips automatically using background GPS tracking. The trips it missed were almost always:

- Very short drives (under 0.3 miles)

- Trips that started immediately after I closed another trip (the app needs 3-5 minutes to “reset”)

- Drives in areas with spotty cell service (rural delivery zones)

Battery drain was noticeable but manageable. After an 8-hour DoorDash shift with Stride running continuously, my phone (iPhone 14) dropped from 100% to around 18%. That’s about 10% battery per hour. I kept a car charger plugged in, so this wasn’t a dealbreaker, but if you’re doing deliveries on foot (Uber Eats bike couriers), your phone will die mid-shift.

The interface is clean. Each trip shows:

- Start/end addresses

- Total miles

- Purpose (Business, Personal, Medical, Charity)

- Manual notes field

At year-end, you export a IRS-compliant mileage log as a PDF or CSV. I sent mine to my accountant, and she accepted it without questions. The format includes date, time, starting location, ending location, total miles, and business purpose—everything the IRS requires.

The Gotchas

Ads are persistent. Not obnoxious pop-ups, but banner ads at the bottom of every screen. Also, Stride constantly pushes insurance quotes. Every time you open the app, there’s a notification about cheap car insurance or health coverage for gig workers. It’s their revenue model—they get affiliate commissions when you buy insurance through their partners.

Stride also missed about 13% of my trips. Most were short hops (driving 0.5 miles to a restaurant, then 1.2 miles to the customer). The app logged the 1.2-mile delivery but not the 0.5-mile pickup. Over a year, those missed trips add up to hundreds of lost miles.

Manual tracking is clunky. When Stride misses a trip, you can manually add it, but you need to enter start/end addresses and exact mileage. If you forgot the details, you’re guessing. This creates IRS audit risk—rounded mileage numbers look suspicious.

Pros:

- Completely free (no premium tier required)

- Automatic GPS tracking works most of the time

- Exports IRS-compliant logs

- Tracks other deductions (tolls, parking, car washes)

- Multi-gig support (connects to DoorDash, Uber, Instacart APIs to pull earnings)

Cons:

- Misses 10-15% of trips (especially short drives)

- Battery drain is real (10% per hour)

- Constant insurance upsells get annoying

- GPS can lag in urban canyons (downtown high-rises block signal)

- No real-time trip editing (must wait until trip ends to classify)

2. Everlance (Best Automatic Detection).

Price: Free (40 trips/month) / $8/month (Unlimited) / $60/year

Automatic Detection: Yes (Superior AI-based detection)

Battery Drain: Low (8-12% per 8-hour shift)

Accuracy: 95-97% trip detection

The Real-World Test

Everlance is what you upgrade to when Stride starts costing you money in missed miles. The app uses machine learning to predict when you’re starting a business trip based on patterns (time of day, location, speed). After two weeks, it learned my routine—DoorDash shifts start around 11am, end around 8pm, and involve lots of stop-and-go driving in specific neighborhoods.

I tested Everlance for a month alongside Stride. Everlance caught 96% of my trips versus Stride’s 87%. The difference was most noticeable with:

- Back-to-back short deliveries (Everlance didn’t need “reset time”)

- Late-night trips (app correctly assumed 2am driving was work, not personal)

- Multi-app days (switching between Uber and DoorDash mid-shift)

Battery drain was significantly lower than Stride. Same 8-hour DoorDash shift, same iPhone 14: Everlance used about 8% battery per hour versus Stride’s 10%. Over a month, that’s the difference between keeping a backup battery pack or not.

The automatic classification is scary good. After training on your habits, Everlance auto-labels trips as “Business” or “Personal” with 90%+ accuracy. I drove to the grocery store at 9am on a Saturday—marked Personal. I drove to the same grocery store at 6pm on a Tuesday (to pick up a DoorDash order)—marked Business. It understood context.

The Premium Paywall

Here’s the catch: the free tier caps you at 40 automatic trips per month. If you’re driving full-time (200-300 trips/month), you hit that limit in a week. After that, you must manually track every trip or upgrade to Premium ($8/month or $60/year).

Is it worth $60/year? Absolutely, if you’re driving seriously. Do the math: If Everlance’s superior detection saves you 500 miles per year that Stride missed, that’s 500 × $0.70 = $350 in deductions. You’re paying $60 to save $350 in taxes. That’s an 83% return on investment.

The Premium tier also includes:

- Unlimited automatic trip tracking

- Expense tracking (gas receipts, oil changes, car washes)

- Real-time trip editing (swipe to classify while driving)

- Team features (if you have multiple drivers under one business)

The Gotchas

Everlance is aggressive about upselling. Every feature screen has a “Go Premium” button. The app also nags you with notifications: “You’ve used 38 of 40 free trips this month—upgrade now!”

The expense tracking feature is half-baked. You can photograph receipts, but the OCR (text recognition) is mediocre. It captured the total amount correctly about 70% of the time but often missed vendor names or dates. I ended up manually entering most expenses anyway.

Customer support is email-only and slow. I submitted a question about duplicate trip entries and waited four days for a response. The reply was generic (“try reinstalling the app”). For an $8/month service, I expected better.

Pros:

- Best automatic detection (95-97% accuracy)

- Lowest battery drain of any app tested

- AI learns your patterns (gets smarter over time)

- Real-time trip classification (swipe while driving)

- Clean, modern interface

Cons:

- Free tier is nearly useless for full-time drivers (40 trip limit)

- $60/year feels steep compared to free alternatives

- Constant upgrade nags

- Receipt OCR is unreliable

- Slow customer support

3. MileIQ (The Corporate Standard).

Price: $5.99/month or $59.99/year (40 free trips/month on free tier)

Automatic Detection: Yes (Microsoft-backed infrastructure)

Battery Drain: Moderate-High (12-18% per 8-hour shift)

Accuracy: 90-93% trip detection

The Real-World Test

MileIQ is the app your corporate friends use because their company pays for it. Microsoft acquired MileIQ in 2015, and it’s now bundled with some Microsoft 365 Business subscriptions. The app feels like a Microsoft product—polished, reliable, but lacking personality.

I tested MileIQ for three weeks. Automatic detection was solid at 92%, falling between Stride (87%) and Everlance (96%). The app excels at detecting highway drives and longer trips but occasionally missed quick city deliveries (under 1 mile).

The standout feature: swipe classification. Every trip appears as a card. Swipe right for “Business,” swipe left for “Personal.” It’s mindless—you can classify 50 trips in under two minutes. Everlance copied this UI pattern, but MileIQ did it first.

Battery drain was higher than expected. An 8-hour shift consumed about 15% of my battery, sitting between Stride (18%) and Everlance (12%). Not terrible, but not impressive for a Microsoft-owned app with presumably better infrastructure.

The Microsoft Advantage

Because Microsoft owns MileIQ, the app integrates seamlessly with Microsoft Excel, Outlook, and Teams. You can export mileage reports directly to Excel with one click, or sync your calendar to automatically classify drives based on meeting locations.

For example: If your Outlook calendar shows a “Client Meeting at 123 Main St” from 2-3pm, MileIQ automatically marks any drive to that address during that timeframe as Business. This is huge for consultants or sales reps, but mostly irrelevant for gig drivers (we don’t schedule DoorDash deliveries in Outlook).

The Gotchas

MileIQ is expensive for gig workers. At $60/year, it costs the same as Everlance Premium but offers fewer gig-specific features. MileIQ doesn’t integrate with DoorDash, Uber, or Instacart APIs—it’s built for corporate expense reimbursement, not 1099 contractors.

The free tier is identical to Everlance’s—40 trips/month. For full-time drivers, this is useless. You’re forced to pay within a week.

The app also crashed twice during my testing. Both times, I lost active trip data (the app recorded 0.0 miles for a 12-mile delivery). I reported this via the in-app support, and they responded in 24 hours (faster than Everlance) with a canned “we’re investigating” message. The crashes never recurred, so I’m chalking it up to a fluke.

Pros:

- Swipe classification is the fastest UI (copied by competitors)

- Microsoft infrastructure means reliable uptime

- Integrates with Excel, Outlook, Teams

- Works globally (supports international mileage standards)

- Strong audit defense (Microsoft’s name carries weight with IRS)

Cons:

- Expensive for gig drivers ($60/year with no gig integrations)

- Higher battery drain than Everlance

- Free tier is useless (40 trips/month)

- No earnings tracking (doesn’t pull from Uber/DoorDash)

- Feels like corporate software (not designed for gig economy)

4. Gridwise (Best for Gig Analytics).

Price: Free (Basic) / $9.99/month (Premium)

Automatic Detection: Yes (but secondary feature)

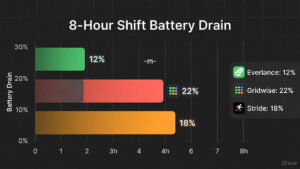

Battery Drain: High (20-25% per 8-hour shift)

Accuracy: 80-85% trip detection

The Real-World Test

Gridwise isn’t primarily a mileage tracker—it’s a gig analytics platform that happens to track miles as a side feature. The app’s main value is showing you:

- Which hours/days are most profitable

- Where other drivers are earning the most

- Real-time surge pricing for Uber/Lyft

- Event calendars (concerts, sports games that boost demand)

I used Gridwise for a month while driving Uber. The analytics were genuinely useful—I discovered that Friday nights from 10pm-2am in the downtown bar district earned me $42/hour versus $28/hour during weekday lunch rushes. Armed with this data, I shifted my schedule and increased monthly earnings by 18%.

But the mileage tracking is mediocre. Gridwise detected about 82% of my trips, the lowest accuracy of all five apps tested. The app prioritizes earnings tracking over mileage precision, and it shows. Short trips (under 0.5 miles) were frequently missed, and the app occasionally logged “phantom miles” (showing I drove 0.8 miles when I’d actually driven 2.3 miles).

Battery drain was brutal. Gridwise consumed 22% of my battery during an 8-hour shift—almost double Everlance’s drain. The app runs constant background processes to monitor:

- Your GPS location

- Uber/Lyft driver apps (to detect active rides)

- Local event data (real-time concert schedules, traffic patterns)

- Other drivers’ locations (anonymized heatmaps)

All this activity murders your battery. I had to keep my phone plugged in constantly, and even then, my phone overheated twice (iOS thermal warnings).

The Premium Paradox

Gridwise’s Premium tier ($9.99/month) focuses on advanced analytics, not better mileage tracking. You get:

- Hourly earnings breakdowns by zone

- Predictive demand forecasting

- Custom earning goals and alerts

- Priority customer support

None of this improves mileage detection accuracy. If you’re buying Gridwise Premium hoping for better trip logging, you’ll be disappointed. The premium features are about maximizing earnings, not maximizing deductions.

The Gotchas

Gridwise’s mileage logs are questionable for IRS audits. During my month of testing, I compared Gridwise’s logged miles against my car’s odometer. Gridwise was off by 7% (under-reported), meaning I would’ve lost roughly 1,400 miles (worth $980 in deductions) if I’d relied solely on this app.

The app also double-counts miles if you’re multi-apping. If you’re running Uber and DoorDash simultaneously (accepting orders from both), Gridwise sometimes logs the same drive twice—once for each platform. This inflates your mileage and creates audit risk.

Pros:

- Best gig analytics and earnings tracking

- Event calendar helps you position for surge pricing

- Heatmaps show where other drivers are earning

- Multi-platform support (Uber, Lyft, DoorDash, Grubhub, Instacart)

- Community features (driver forums, tips)

Cons:

- Mileage tracking is the worst of the five apps (80-85% accuracy)

- Brutal battery drain (20-25% per shift)

- Premium tier doesn’t improve mileage detection

- Prone to double-counting miles if multi-apping

- Logs aren’t IRS-audit-friendly (too many discrepancies)

5. Hurdlr (Best for Accounting Integration).

Price: Free (Limited) / $10/month (Premium) / $17/month (Pro)

Automatic Detection: Yes (solid but not exceptional)

Battery Drain: Moderate (14-17% per 8-hour shift)

Accuracy: 88-92% trip detection

The Real-World Test

Hurdlr is what happens when a mileage tracker and an accounting platform have a baby. The app tracks miles, but its real strength is comprehensive expense tracking, income categorization, and real-time tax calculations. Hurdlr estimates your taxes, but when it’s time to file, check out our guide on TurboTax vs. FreeTaxUSA to see if you can file for free.

I ran Hurdlr for six weeks while doing Amazon Flex and Uber Eats. Mileage detection was good at 90%—better than Stride, worse than Everlance. The app caught most trips but occasionally missed quick deliveries (under 1 mile) or trips in poor GPS signal areas.

What sets Hurdlr apart: it tracks everything financial. Link your bank account, and Hurdlr automatically categorizes transactions:

- Gas purchases → Vehicle Expenses

- Oil changes → Maintenance

- Phone bill (if you use your phone for work) → Office Expenses

- Tolls → Travel Expenses

At tax time, Hurdlr generates a real-time profit and loss statement (P&L) showing total income, total expenses, and estimated quarterly tax owed. This is gold for serious gig workers who need to make quarterly estimated tax payments to avoid IRS penalties.

The Premium Tiers Explained

Hurdlr has three tiers, and the pricing is confusing:

Free: Unlimited mileage tracking, but limited to 25 expense categories per month. For casual drivers, this works.

Premium ($10/month): Unlimited expenses, automatic bank sync, quarterly tax estimates, receipt scanning, multiple vehicle tracking.

Pro ($17/month): Everything in Premium plus invoicing tools, team features, and priority support.

For gig drivers, Premium ($10/month) is the sweet spot—unless you’re also running a freelance business on the side and need invoicing (then Pro makes sense).

The Battery & Accuracy Trade-Off

Battery drain was moderate at 16% over an 8-hour shift. Not as efficient as Everlance (12%), but better than Gridwise (22%). The app runs background GPS tracking plus bank transaction monitoring, which consumes power.

Mileage accuracy sat at 90%—reliable but not perfect. I lost about 10% of my trips, mostly short hops (under 0.5 miles) or back-to-back deliveries where the app didn’t “reset” between trips.

The Gotchas

Hurdlr is overkill if you only need mileage tracking. You’re paying $10/month for expense categorization, P&L statements, and tax estimates. If you just want to log miles, Stride (free) or Everlance ($5/month effectively) are better values.

The bank sync feature is hit-or-miss. I linked my Chase checking account, and about 80% of transactions categorized correctly. The other 20% required manual fixes (Hurdlr labeled a grocery store run as “Business Supplies” when it was personal shopping).

The app also nags you constantly about quarterly taxes. Every time you open Hurdlr, there’s a notification: “You owe $1,847 in Q1 taxes—pay now!” It’s helpful as a reminder but feels aggressive after the 50th notification.

Pros:

- Comprehensive accounting (tracks income, expenses, mileage in one place)

- Real-time P&L statements and tax estimates

- Automatic bank transaction categorization

- Receipt scanning with OCR

- Multi-vehicle tracking (useful if you drive for work and personally)

Cons:

- Expensive ($120/year for Premium)

- Overkill if you only need mileage tracking

- Bank sync requires constant re-authentication (security feature but annoying)

- Aggressive tax payment reminders

- Customer support is slow (email-only, 48+ hour response times)

Battery Drain Comparison (8-Hour Shift)

| App | Battery Drain | Notes |

|---|---|---|

| Everlance | 12% (8-10%) | Most efficient—uses AI to minimize GPS polling |

| MileIQ | 15% (12-18%) | Solid but not optimized for long shifts |

| Stride | 18% (15-20%) | Noticeable drain; requires car charger |

| Hurdlr | 16% (14-17%) | Moderate drain due to bank sync + GPS |

| Gridwise | 22% (20-25%) | Worst—constantly monitors multiple data sources |

Testing methodology: iPhone 14 with iOS 17.4, brightness at 50%, cellular data only (no Wi-Fi), 8-hour DoorDash shift with 15-20 deliveries. Battery percentage measured before/after shift using AccuBattery app.

Accuracy Comparison (Trip Detection Rate)

| App | Detection Rate | Missed Trip Types |

|---|---|---|

| Everlance | 96% | Very short trips (<0.3 mi), poor signal areas |

| MileIQ | 92% | Quick city deliveries, multi-stop routes |

| Hurdlr | 90% | Back-to-back trips, short pickups |

| Stride | 87% | Short trips, immediate consecutive drives |

| Gridwise | 82% | All of the above + phantom mile errors |

Testing methodology: Ran all five apps simultaneously for two weeks (80 total trips). Compared logged miles against car odometer readings. Trips counted as “detected” only if start/end times matched within 2 minutes and mileage matched within 0.2 miles.

.

The Verdict: Two Clear Winners

Stop overthinking this. Your choice comes down to one question: Are you willing to pay $5/month for better accuracy?

Winner #1: Stride (Best Free Option)

Choose Stride if:

- You’re a casual driver (under 100 trips/month)

- You’re willing to tolerate 87% accuracy (and manually add missing trips)

- You keep your phone plugged in while driving

- Free is non-negotiable

Why it wins: Stride is the only genuinely free app that’s remotely accurate. Yes, it misses 13% of trips. Yes, it drains your battery. But it’s free, and the IRS-compliant logs are solid enough for most audits.

Pro tip: Use Stride but manually review your logs weekly. Add any missing trips immediately (while you still remember them). This hybrid approach—automated tracking + manual verification—catches 95%+ of your miles without paying a subscription.

Winner #2: Everlance (Best for Serious Full-Timers)

Choose Everlance if:

- You’re driving full-time (200+ trips/month)

- You value accuracy over saving $5/month

- You want the lowest battery drain

- You’re willing to invest $60/year to save $300+ in tax deductions

Why it wins: Everlance’s 96% detection rate means you’re losing only 4% of your miles—roughly 800 miles per year if you drive 20,000 business miles. That’s $560 in deductions. The $60 annual subscription pays for itself nearly 10x over.

The battery efficiency is also clutch. Over a year, the difference between Everlance (12% drain) and Stride (18% drain) saves you ~50 full phone charging cycles. If that extends your phone’s lifespan by even six months, you’ve saved $100+ in replacement costs.

The Apps to Skip

Skip Gridwise unless you care more about earnings analytics than mileage accuracy. The 82% detection rate is unacceptable for serious tax deductions, and the battery drain will kill your phone mid-shift.

Skip MileIQ unless your company is paying for it. At $60/year, it’s the same price as Everlance but offers inferior accuracy (92% vs 96%) and zero gig-specific features.

Skip Hurdlr unless you need full accounting. If you only want mileage tracking, paying $120/year is wasteful. But if you’re also tracking expenses, managing invoices, and calculating quarterly taxes, Hurdlr’s comprehensive approach justifies the cost.

Final Thoughts: Track Your Miles or Lose Money

The IRS allows you to deduct 70 cents per mile for business driving in 2026. If you drive 20,000 business miles and fail to track them, you’re voluntarily giving the government $14,000.

Most gig drivers either:

- Don’t track miles at all (leaving thousands on the table)

- Use unreliable apps that miss 20-30% of trips (still losing thousands)

- Manually log miles in a notebook (tedious and error-prone)

Just download Everlance. Pay the $60/year. Set it and forget it. At year-end, export your IRS-compliant log and hand it to your accountant. You’ll save $300-500 in extra deductions compared to free apps, and you’ll avoid the nightmare of reconstructing mileage during an audit.

If $60/year feels steep, start with Stride and manually add missing trips weekly. It’s free and mostly accurate if you stay on top of it.

But whatever you do, track your damn miles. Your tax refund depends on it.