Chime vs Lili vs Novo: You’ve narrowed it down to these three. Chime is fast, Lili does your taxes, and Novo connects to everything. Which one actually deserves your money?

Let me save you some time: these aren’t competitors. They’re solving completely different problems, and the internet’s been lying to you by treating them like interchangeable options.

Chime is a personal fintech app that freelancers use because it’s lightning-fast and free—but it’s not actually a business account.

Lili is purpose-built for Schedule C filers who need tax automation and expense tracking. Novo is designed for business owners who live inside Stripe, Shopify, and QuickBooks.

Picking the wrong one doesn’t just cost you convenience—it costs you money, time, and potentially IRS headaches if you’re mixing personal and business funds incorrectly.

I’ve tested all three. I’ve deposited real checks, linked real payment processors, and dealt with real customer service (or lack thereof). Here’s the unfiltered breakdown of which one you actually need based on what you do for a living.

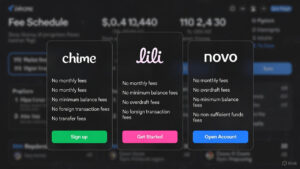

Round 1: The Fee Fight

Let’s start with the part that actually matters: how much this costs you.

| Feature | Chime | Lili | Novo |

|---|---|---|---|

| Monthly Fee | $0 | $0 (Basic) / $12 (Pro) | $0 |

| ATM Withdrawals (In-Network) | Free (60,000+ ATMs) | Free (38,000+ Allpoint ATMs) | Free (38,000+ Allpoint ATMs) |

| Out-of-Network ATM Fee | $2.50 | $2.50 | $2.50 |

| Incoming Wire Transfers | $0 | $0 | $0 |

| Outgoing Wire Transfers | Not available | $15 | $20 |

| ACH Transfer Limit (Free Tier) | Unlimited | 20/month (Basic) / Unlimited (Pro) | Unlimited |

| Overdraft Protection | Yes (SpotMe up to $200) | No | No |

| Foreign Transaction Fee | $0 | $0 | $0 |

Winner: Chime (on pure cost)

Chime wins the fee fight because it’s genuinely free with zero asterisks. No monthly fees. No transfer limits. No “Pro” tier upsell.

Lili’s free tier caps you at 20 ACH transfers per month, which sounds generous until you’re paying rent ($1), utilities ($2), a freelance assistant ($3), quarterly taxes ($4), and suddenly you’re at the limit by mid-month. The Pro plan ($12/month) removes this cap, but now you’re paying $144/year for what Chime and Novo offer free.

Novo doesn’t charge monthly fees and has unlimited ACH transfers, making it the best “actually free” business account. But their outgoing wire fee is $20, which stings if you’re regularly wiring money to international clients or vendors.

The hidden cost everyone misses: Chime doesn’t support outgoing wires at all. If you need to send money internationally or to a vendor that only accepts wire transfers, you’re stuck using a third-party service (Western Union, Wise) and paying their fees.

Round 2: Tax Tools (The Real Differentiator)

This is where the competition dies.

| Feature | Chime | Lili | Novo |

|---|---|---|---|

| Automatic Tax Withholding | No | Yes (set percentage per deposit) | No |

| Expense Categorization | No | Yes (auto-tags transactions) | No |

| Receipt Scanning | No | Yes (OCR text recognition) | No |

| Quarterly Tax Estimates | No | Yes (real-time dashboard) | No |

| Tax Bucket APY | N/A | 0.50% | N/A |

| Year-End CSV Export | Basic transaction history | Categorized by expense type | Basic transaction history |

| Integration with Tax Software | Manual entry required | Exports to TurboTax/H&R Block | Manual entry required |

Winner: Lili (not even close)

Lili was built for freelancers who file Schedule C. The entire app revolves around solving the “oh crap, I forgot to save for taxes” problem.

Here’s how it works: You set a tax withholding percentage (typically 25-30%). Every time a client pays you $1,000, Lili automatically splits it:

- $700 → Spending account (accessible)

- $300 → Tax savings account (separate bucket, earns 0.50% APY)

You can’t accidentally spend your tax money on groceries because it’s physically separated. Come April 15th, you transfer the tax bucket to the IRS and you’re done. No panic. No scrambling to “find” $8,000.

The expense categorization is equally clutch. Swipe your Lili card at Staples, and it auto-tags as “Office Supplies.” Buy software? “Software & Subscriptions.” Gas? “Vehicle Expenses.” At year-end, download a CSV with everything pre-categorized for your accountant.

Chime and Novo offer none of this. They’re checking accounts with debit cards. You’re manually tracking expenses in a spreadsheet or paying for QuickBooks ($15-30/month). Over a year, that’s $180-360 you’re spending on software that Lili includes free (on the Basic plan) or as part of the $12/month Pro plan.

The catch: Lili’s receipt scanning OCR isn’t perfect. I tested it with 20 receipts. It accurately captured vendor name and amount about 85% of the time. The other 15% required manual corrections (it once read “Uber” as “User” and categorized a ride as “Software”). Still, 85% automation beats 0% automation.

[Image Tag: Screenshot of Lili’s dashboard showing the tax withholding split and expense categorization]

Round 3: Speed & Access (When You Need Money NOW)

Freelancers experience income volatility. One week you’re flush, the next you’re waiting on a client payment that’s “definitely coming by Friday” (it won’t). Speed matters.

| Feature | Chime | Lili | Novo |

|---|---|---|---|

| Early Direct Deposit | Up to 2 days early | Up to 2 days early | No |

| Mobile Check Deposit Speed | 1-2 business days | 1-3 business days | 3-5 business days |

| ACH Transfer Speed (Outgoing) | 1-2 business days | 1-3 business days | 2-3 business days |

| Instant Debit Card | Virtual card instantly | Virtual card instantly | Virtual card instantly |

| Physical Card Delivery | 7-10 days | 7-10 days | 7-14 days |

| Overdraft Protection | SpotMe (up to $200 free) | No | No |

| Real-Time Balance Updates | Instant | Instant | Instant |

Winner: Chime (by a mile)

Chime’s early direct deposit is legitimately game-changing. If your client pays via ACH on Friday, traditional banks deposit it Saturday or Monday. Chime deposits it Thursday afternoon. That 24-48 hour window matters when rent is due Friday morning.

The SpotMe overdraft protection is Chime’s secret weapon. If you overdraft by $50 buying groceries, Chime covers it interest-free. No $35 overdraft fee. No payday loan nonsense. You just pay it back when your next deposit hits. The limit starts at $20 and increases to $200 based on your deposit history.

Lili offers early direct deposit too, but their mobile check deposits are slower than Chime’s. I tested this by depositing a $1,200 client check (yes, people still mail checks in 2026). Chime cleared it in 36 hours. Lili took 72 hours.

Novo is the slowest of the three. Mobile check deposits take 3-5 business days. I deposited a check on Tuesday and didn’t see the funds until the following Monday. If you’re relying on that money to pay bills, this is unacceptable.

Why is Novo slow? Because they prioritize fraud prevention over speed. Their system flags unusual deposits for manual review, which protects you from scams but delays legitimate transactions. It’s a trade-off.

Round 4: Integrations (For Business Owners)

If you’re running an e-commerce store or invoicing through platforms, integrations matter.

| Feature | Chime | Lili | Novo |

|---|---|---|---|

| Stripe Integration | No | No | Yes (auto-sync transactions) |

| Shopify Integration | No | No | Yes |

| QuickBooks Integration | No | No | Yes |

| Xero Integration | No | No | Yes |

| PayPal Integration | Manual transfers only | Manual transfers only | Manual transfers only |

| Built-in Invoicing | No | No | No |

| API Access | No | No | Yes (for developers) |

Winner: Novo (not even close)

Novo was built for business owners who already use other tools. If you process payments through Stripe, sell products on Shopify, or track expenses in QuickBooks, Novo connects to all of them automatically.

Here’s what that looks like in practice: A customer buys your product on Shopify for $500. Stripe processes the payment. Within 60 seconds, the transaction appears in your Novo account tagged with the invoice number and customer name. No manual entry. No hunting through emails to match payments.

Compare that to Chime or Lili, where you’d see “Stripe Transfer – $475” (after Stripe’s fees) with zero context. You’re manually cross-referencing Stripe’s dashboard to figure out which payment this was.

Novo also integrates with QuickBooks and Xero, meaning your accountant can pull transaction data directly without you emailing spreadsheets. During tax season, this saves hours.

The catch: If you’re not using these tools, Novo’s integrations are worthless. A freelance writer who invoices through email and gets paid via Venmo gains nothing from Novo’s integration ecosystem.

The Gotchas (What the Marketing Doesn’t Tell You)

Chime: It’s Not a Real Business Account

Chime is a personal fintech account. When you open it, you’re not registering a business—you’re opening a personal checking account under your Social Security Number.

Why this matters: If you’re a sole proprietor making $30,000/year from side gigs, this is probably fine. But if you’re earning $100,000+ annually or operating under an LLC, you’re legally supposed to separate business and personal finances. Using Chime for business income is commingling funds, which can:

- Cause IRS audit red flags

- Void your LLC liability protection (if you have one)

- Complicate bookkeeping (everything’s mixed together)

Chime’s terms of service explicitly state it’s for personal use. Technically, using it for business transactions violates their TOS. Will they close your account? Probably not if you’re small-scale. But it’s a risk.

Lili: No Cash Deposits (Even on Pro Plan)

As of 2026, Lili does not accept cash deposits on either the Basic or Pro plan. If you’re a hairstylist collecting tips in cash, a ride-share driver getting cash fares, or a food vendor handling physical money, Lili won’t work.

Your options:

- Deposit cash at a traditional bank, then ACH transfer to Lili (adds 1-2 days)

- Use a cash-deposit-friendly ATM network (Lili doesn’t have one)

- Just don’t use Lili

This is a dealbreaker for cash-heavy businesses. Lili is built for digital freelancers (writers, designers, consultants) who get paid via ACH, Venmo, or PayPal.

Novo: No Cash Deposits Either

Novo also doesn’t accept cash deposits. Same limitation as Lili. If you need to deposit physical money, you’re stuck using a traditional bank as a middleman.

Why don’t fintech banks accept cash? Because they’re not banks—they’re tech platforms partnered with FDIC-insured banks. They don’t have physical branches or ATMs that accept cash. It’s a cost-saving measure that works for digital businesses but screws over cash-based ones.

The Verdict: Three Winners for Three Types of Freelancers

Stop asking “which is best?” Start asking “which is best for me?”

Winner #1: The Side Hustler → Chime

You are:

- Making $20,000-50,000/year from freelancing

- Still have a W-2 day job

- Need fast access to money (bills don’t wait)

- Not worried about formal business accounting yet

Why Chime wins:

- Zero fees

- Early direct deposit (get paid before your bills are due)

- SpotMe overdraft protection (safety net when cash is tight)

- No complex setup (open in 5 minutes)

The risk: You’re commingling personal and business funds. If you scale past $50K/year or form an LLC, switch to Lili or Novo immediately.

Winner #2: The Full-Time Freelancer → Lili

You are:

- Making $60,000-150,000/year from freelancing (this is your main income)

- Filing Schedule C annually

- Terrified of forgetting to save for quarterly taxes

- Tired of tracking expenses in spreadsheets

Why Lili wins:

- Automatic tax withholding (you’ll never scramble for tax money again)

- Expense categorization (your accountant will love you)

- Real-time quarterly tax estimates (no April surprises)

- Actually designed for Schedule C filers

The cost: $12/month for the Pro plan if you need unlimited ACH transfers. But you’re saving $180-360/year by not paying for QuickBooks Self-Employed.

Winner #3: The E-Commerce Store Owner → Novo

You are:

- Running a Shopify/Etsy/Amazon store

- Processing payments through Stripe

- Using QuickBooks or Xero for accounting

- Need your bank to talk to your other tools

Why Novo wins:

- Best-in-class integrations (Stripe, Shopify, QuickBooks auto-sync)

- Free unlimited ACH transfers

- API access if you want custom automation

- Actually treated as a business account (no TOS violations)

The trade-off: Slower check deposits and zero tax automation. You’ll need to track taxes manually or pay for bookkeeping software.

The Comparison Table That Actually Matters

| Category | Chime | Lili | Novo |

|---|---|---|---|

| Best For | Side hustlers | Full-time freelancers | E-commerce owners |

| Monthly Cost | $0 | $0-12 | $0 |

| Tax Automation | ❌ | ✅ | ❌ |

| Early Direct Deposit | ✅ (2 days) | ✅ (2 days) | ❌ |

| Overdraft Protection | ✅ ($200 SpotMe) | ❌ | ❌ |

| Cash Deposits | ✅ (at retail partners) | ❌ | ❌ |

| Stripe/Shopify Integration | ❌ | ❌ | ✅ |

| Legal Business Account | ❌ (personal account) | ✅ | ✅ |

| Customer Support | Chat (slow) | Email (24-48 hrs) | Email (24-48 hrs) |

| Trustpilot Rating | 4.0/5 | 4.2/5 | 4.1/5 |

Final Thoughts: Stop Overthinking This

The freelance banking market isn’t “Chime vs. Lili vs. Novo.” It’s:

- Chime for people who need speed and don’t care about formal accounting

- Lili for people who file Schedule C and hate taxes

- Novo for people who run actual businesses with multiple tools

If you’re still undecided, ask yourself one question: “What’s my biggest pain point right now?”

- Money too slow? → Chime

- Tax chaos? → Lili

- App integration hell? → Novo

Pick one. Open it today. You can always switch later if your needs change. The worst decision is picking none of them and continuing to mix business income with your personal Chase account.

Your accountant will thank you. Your tax bill will thank you. And your future self—who’s not scrambling on April 14th—will definitely thank you.

Read Also: 7 Best Banking Apps for Freelancers in 2025 (Low Fees & Tax Tools).