TikTok made me do it. I withdrew my entire paycheck in cash. My bank teller looked at me like I was a drug dealer.

“That’s… $2,400. In twenties,” she said, counting out 120 bills with the kind of concern usually reserved for people cashing lottery tickets at gas stations. “Is everything okay?”

“I’m trying cash stuffing,” I explained, immediately regretting it.

“The… envelope thing?”

“Yeah.”

She slid the brick of cash across the counter. “Good luck.”

I’m 29. I make $72,000 a year as a marketing coordinator. I have a 401(k), maxed-out HSA contributions, and a credit card that earns 2% cash back on everything. I use Venmo like it’s oxygen. I haven’t carried a wallet with actual cash in it since 2019.

So why was I about to spend a month living like it’s 1987?

Because despite making what feels like good money, I’m somehow always broke. Not “can’t pay rent” broke—more like “why do I have $847 in my checking account on the 28th when I got paid $4,200 three weeks ago?” broke. The money just… disappears. A $14 DoorDash order here. A $47 Target run there. Subscriptions I forgot I had. It all blends together into a vague cloud of “I think I’m being responsible?”

I needed a reset. And according to 47 million TikToks tagged #cashstuffing, the envelope system was the answer.

Spoiler: It worked. But not for the reasons I expected.

The Setup: Designing My Cash Stuffing System

Cash stuffing for beginners starts with a simple premise: withdraw your budgeted spending money in cash, divide it into category-specific envelopes, and when the cash is gone, you’re done spending. No credit cards. No “I’ll just move money from savings.” Once it’s empty, you’re eating pantry pasta until payday.

I spent a weekend designing my system. I bought a $12 binder from Target (ironically using my credit card one last time), printed category labels on my roommate’s printer, and created four main envelopes:

1. Groceries: $400/month

This covered actual food shopping—not DoorDash, not the Starbucks I grab before work, just groceries from Trader Joe’s or Whole Foods.

2. Dining Out: $300/month

Restaurants, bars, coffee shops, that $18 açai bowl I pretend is a meal. If someone else prepared it, it came from this envelope.

3. Fun Money: $200/month

Concert tickets, spontaneous Target runs, the candle I don’t need but smells like “eucalyptus rain.” Anything that’s pure want, not need.

4. Gas: $120/month

I drive a 2019 Honda Civic. Gas in my city averages $4.20/gallon. This should’ve been plenty.

Total monthly cash budget: $1,020

The rest of my paycheck went to automated transfers: rent ($1,650), utilities ($80), car insurance ($110), subscriptions I actually use ($47 for Spotify, gym, and iCloud storage), and 15% to savings/investments ($630). Those stayed on autopay—I wasn’t about to mail a rent check like a Boomer.

The Rules:

- Once I stuffed the envelopes on payday, no refills until next payday

- No using credit cards for categories I’d allocated cash to

- If I ran out of cash in one category, I could “borrow” from another—but I had to physically move the money and acknowledge the trade-off

- Emergencies (car breaks down, medical) could use credit cards—I’m not a masochist

I withdrew $1,020 in cash on February 1st (all twenties, because ATMs don’t dispense tens anymore apparently). I spent 45 minutes organizing it into envelopes, labeling everything with cute fonts I found on Canva, and taking a photo for Instagram Stories with the caption “Becoming fiscally responsible, I guess 💸✨”

Three people replied asking if I’d joined an MLM.

Week 1: The Honeymoon Phase (This Is Actually Fun?)

The first week felt like playing a game. I went to Trader Joe’s with my $400 Groceries envelope and actually thought about what I was buying.

Normally, I shop with my credit card on autopilot. Oat milk? Sure. Organic blueberries for $8? Why not. That weird truffle cheese? Into the cart. I’d check out, tap my card, and later see “$147” on my Mint app and think, “How did I spend that much?”

But with cash, every item had weight. I’m holding $400 in my hand. These blueberries are $8, which is forty percent of a twenty-dollar bill. Do I want to trade half of this bill for berries, or can I buy frozen?

I bought frozen.

For the first time in years, I actually used a shopping list. I put things back when my mental math said I was approaching $100. I skipped the impulse candy at checkout because I could see the cash leaving my wallet in real-time.

Week 1 grocery spending: $87

I felt like a genius.

Dining Out was equally trippy. I met friends for brunch on Saturday. The bill came, and I opened my wallet to see five twenty-dollar bills. The meal cost $34 (including tip). I handed over two twenties, got six dollars back, and physically felt $34 leave my possession.

Compare that to tapping my credit card, where the pain of payment is delayed until I see a notification three days later that says “You spent $34 at Snooze AM Eatery.” By then, it’s already forgotten. The dopamine from the meal is gone, but the regret lingers.

This is the psychology that makes cash stuffing work: The “pain of paying” is immediate and visceral. Your brain actually processes handing over cash differently than swiping a card. Studies (MIT, 2008) found that people spend 12-18% less when using cash because the transaction hurts more.

By the end of Week 1, I’d spent:

- Groceries: $87

- Dining Out: $76

- Fun: $31 (a book and a candle)

- Gas: $42

Total: $236

I was on track to underspend by hundreds. I texted my best friend: “Cash stuffing is amazing. I’m basically Dave Ramsey now.”

She replied: “Check back in three weeks.”

Week 2: The Annoyance (Modern Life Hates Cash)

Week 2 is when I remembered why we invented credit cards in the first place: cash is wildly inconvenient in 2026.

I stopped at a gas station to fill up my tank. I walked inside to prepay (because modern pumps don’t always accept cash at the pump anymore). The cashier was helping someone with a lottery ticket. I waited. And waited. Five minutes later, I prepaid $40, pumped my gas, went back inside to get my $3 change, and waited again.

Total time: 12 minutes.

With a credit card, I’d have been done in 90 seconds.

I went to a coffee shop that had gone “cashless only” (ironically after a sign claiming it was “to improve speed”). I had to break my own rule and use my credit card, then manually deduct $6 from my Dining Out envelope when I got home and put that cash in a “Credit Card Payback” envelope I’d created on the fly.

The system was already leaking.

Then came the weekend. A friend invited me to a concert. Tickets were $65 each, purchased online. I couldn’t exactly mail the venue a cash envelope, so I bought them with my credit card, withdrew $65 from my Fun envelope, and added it to the payback pile.

I was managing cash like a part-time accountant. This was not “simple budgeting”—this was bureaucracy.

Week 2 spending:

- Groceries: $93 (running total: $180/$400)

- Dining Out: $84 (total: $160/$300)

- Fun: $89 (concert tickets + their sneaky $7 “fee”; total: $120/$200)

- Gas: $44 (total: $86/$120)

Total: $310

I was still under budget, but the cracks were showing.

Week 3: The Panic (Running Out on a Tuesday).

Week 3 is when cash stuffing really works—because it forces you to confront your own bad habits.

It was Tuesday. I’d already blown through $260 of my $300 Dining Out budget. I had two twenties left. My coworkers invited me to lunch. The restaurant was one of those trendy places where a grain bowl costs $19 before tip.

I opened my Dining Out envelope in the bathroom and stared at those two bills.

This is it. This is all you have for restaurants until the 1st. It’s the 19th.

I went back to the table and said, “Actually, I brought lunch today. I’ll just hang out.”

My coworker Sarah looked at me like I’d grown a second head. “You… brought lunch? You literally never bring lunch.”

She was right. I spent $12-18 on lunch 3-4 times per week, every week, for years. I’d never questioned it because the card swipe was painless.

But when you have $40 in cash and 11 days until payday, you question everything.

I started meal-prepping. I made coffee at home (my Fun envelope couldn’t handle $5 lattes). I said “no” to happy hour on Thursday because my Dining Out money was earmarked for a Saturday dinner I’d already committed to.

For the first time in my adult life, I was making trade-offs in real-time.

Week 3 also brought the dreaded Empty Envelope Moment™. On Friday, my Dining Out envelope had $8 left. I went to a taco truck for dinner. My order came to $14. I opened the envelope. Eight dollars. I opened my wallet. Three ones from random change.

$11 total.

I asked them to remove one taco. The guy looked at me with pity. “You sure? It’s just three more dollars.”

“I’m sure.”

I ate two tacos in my car and felt a weird mix of shame and pride. Shame because I’m 29 years old scrounging cash like a broke college student. Pride because I stuck to the budget.

Week 3 spending:

- Groceries: $88 (total: $268/$400)

- Dining Out: $132 (total: $292/$300, including the sad two-taco dinner)

- Fun: $19 (total: $139/$200)

- Gas: $34 (total: $120/$120—completely empty)

Total: $273

My Gas envelope was bone dry with nine days left in the month. I borrowed $40 from Groceries, knowing I’d have to eat cheaper to compensate. Trade-offs were no longer theoretical—they were sandwiches.

Week 4: The Realization (My Brain Has Been Hacked)

By Week 4, something weird happened: I stopped wanting to spend money.

Not because I’m cheap (I’m not—I have a $400 skincare routine). But because the act of spending had become emotionally expensive. Every purchase required a decision:

- Do I want this $7 iced coffee more than I want $7 left in my Fun envelope?

- Is this $22 sushi bowl worth reducing my Groceries buffer?

- Can I wait four days until payday to buy this thing, or do I need it now?

I’ve tried apps like QuickBooks, but they didn’t stop me from overspending too.

My credit card never asked these questions. It just said “yes” to everything, quietly accumulating a balance I’d pay off later (and then forget about).

But cash made me face every financial decision in the moment. The dopamine hit of buying something was immediately offset by the loss aversion of watching cash leave my hand. Behavioral economics calls this “loss aversion bias”—we feel losses roughly twice as strongly as equivalent gains.

Translation: Spending $20 feels worse than earning $20 feels good.

I finished the month with:

- Groceries: $332/$400 ($68 left over)

- Dining Out: $298/$300 ($2 left—I bought a coffee on the 28th)

- Fun: $167/$200 ($33 left)

- Gas: $120/$120 ($0 left, but I borrowed $40 from Groceries, so net $108 spent)

Week 4 spending: $162

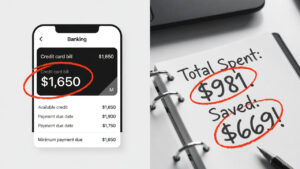

Total month spending: $981 (out of $1,020 budgeted)

The Results: The Math That Matters

I pulled my last three months of credit card statements to compare:

Typical monthly spending (October–December 2025 average):

- Groceries: $520 (Instacart fees, impulse buys, high-end everything)

- Dining Out: $680 (DoorDash, bars, brunch, daily lattes)

- Fun: $310 (Target runs, online shopping, spontaneous concerts)

- Gas: $140 (I’d routinely fill up without checking if I needed a full tank)

Average total: $1,650/month

Cash stuffing month (February 2026): $981

Money saved: $669

That’s $669 I didn’t spend on autopilot. Nearly $8,000 annualized.

But here’s what really got me: I didn’t feel deprived. I still went out with friends. I still ate well (just cooked more). I still had fun (just fewer impulse Amazon orders).

I just thought before I spent.

The Verdict: I Won’t Do It Forever, But It Reset My Brain

Am I converting to cash stuffing for life? No.

Here’s why:

- It’s inconvenient as hell. Gas stations, cashless stores, online shopping—modern life wasn’t built for cash.

- I miss credit card points. I gave up roughly $20 in cash back this month (2% on $1,020 = $20.40).

- It’s socially awkward. Splitting dinner checks with friends when you’re the only one with cash is weird.

- Security risk. I kept $1,000+ in my apartment. If I’d been robbed, that money’s gone forever (no fraud protection like credit cards have).

But here’s what I’m keeping:

1. The “cash envelope” mindset without the physical cash. I’ve set up separate checking accounts for each category (Groceries, Dining Out, Fun, Gas) and auto-transfer my budgeted amounts on payday. When an account hits $0, I stop spending. It’s cash stuffing, digitized.

2. The pain of paying. I deleted my saved credit cards from food delivery apps. Now I have to manually enter my card every time, which adds just enough friction to make me think twice.

3. The weekly review. Every Sunday, I check my envelopes (now accounts) and see what’s left. It takes five minutes and keeps me honest.

The big realization: Cash stuffing works not because cash is magic, but because it forces you to confront spending in real-time instead of retroactively.

Credit cards let you buy now, regret later. Cash makes you regret immediately, which paradoxically feels better. The regret is upfront and manageable (“I only have $8 left, so no coffee today”) instead of delayed and vague (“Why is my credit card bill $2,400?”).

Should You Try Cash Stuffing?

Try it for 30 days if:

- You make decent money but feel broke all the time

- You have no idea where your money goes

- You’ve tried budgeting apps and ignored them

- You’re in debt and need a psychological reset

Skip it if:

- You’re disciplined with credit cards already (if it ain’t broke…)

- You travel frequently (cash is useless abroad)

- Your city is mostly cashless

- You value credit card rewards over behavior change

The envelope system budget 2026 isn’t about going back to the Stone Age. It’s about adding friction to spending so you can’t sleepwalk into broke.

I saved $669 in one month. I ate fewer $18 grain bowls and more homemade pasta. I said “no” to impulse purchases because I could see the cost in my hand.

Would I recommend it? Yeah. Not forever. But for 30 days, it’s the financial equivalent of a juice cleanse—uncomfortable, slightly annoying, but you’ll probably feel better after.

And hey, if nothing else, you’ll confuse the hell out of your bank teller.