You made $100,000 last year as a freelance consultant. Congratulations. Now the IRS wants $30,000 of it.

You panic-Google “how to lower my tax bill” and discover retirement accounts. Your accountant mentions a SEP IRA. You open one, contribute $20,000 (the maximum allowed based on your profit), and pat yourself on the back.

You just left $13,500 on the table.

That’s not a typo. With a Solo 401(k), you could’ve sheltered an additional $13,500 from taxes—money that could’ve compounded tax-free for decades. Instead, you went with the SEP IRA because your accountant said it was “simpler” and you believed the myth that Solo 401(k)s require mountains of paperwork.

Here’s the truth: For the vast majority of solopreneurs earning $80,000 to $250,000 annually, the Solo 401(k) is categorically superior. Higher contribution limits. Roth options. Loan provisions. And the “complexity” everyone warns you about? It’s a single form you file once your balance hits $250,000—years away for most people.

This guide breaks down the Solo 401k vs SEP IRA for self employed debate with actual math, real case studies, and the tax-saving strategies your accountant might not have explained. By the end, you’ll understand why thousands of high-earning freelancers are abandoning SEPs and never looking back.

The SEP IRA: The Sedan (Reliable, But Limited)

Let’s start with the SEP IRA, because it’s what most accountants default to recommending. And to be fair, it has legitimate advantages.

How a SEP IRA Works

A SEP (Simplified Employee Pension) IRA is an employer-funded retirement plan. As a freelancer, you’re both the employer and the employee, so you’re funding it yourself. The mechanics are straightforward:

- You contribute up to 25% of your net self-employment income (after deducting half of your self-employment tax)

- Maximum contribution in 2026: $69,000

- Contributions are pre-tax (they lower your taxable income immediately)

- Money grows tax-deferred until retirement

- No Roth option (all contributions are traditional/pre-tax)

The Math Reality (Where SEPs Fall Short)

Here’s the trap: that “25% of net income” calculation sounds generous until you realize how it actually works.

Let’s say you earned $100,000 in freelance income. Your net self-employment income (the figure SEP calculations use) isn’t $100,000. You first deduct half of your self-employment tax (roughly $7,065), bringing your adjusted net to around $92,935.

Your SEP contribution limit: $92,935 × 0.25 = $23,234

So despite earning six figures, you can only shelter $23,234 from taxes with a SEP. That’s it. End of story.

SEP IRA Pros

- Dead simple to open: Most brokers let you set up a SEP IRA in 10 minutes online

- No annual paperwork: Unlike Solo 401(k)s, you never file anything with the IRS

- High maximum contributions: The $69,000 cap is identical to a Solo 401(k)’s

- Flexible contributions: You can contribute any amount up to the limit (or skip years entirely)

- Works if you have employees: If you hire W-2 employees later, you can keep the SEP (though you’ll have to contribute equally for them too)

SEP IRA Cons

- The 25% ceiling kills your savings potential (especially for incomes under $200K)

- No Roth option: All contributions are pre-tax, meaning you’ll pay taxes on every withdrawal in retirement

- No loan provision: You can’t borrow from your SEP if you hit financial trouble

- No “catch-up” contributions: People 50+ don’t get the extra $7,500 allowed in Solo 401(k)s

- Less control: Once money goes in, your only options are “leave it” or “withdraw it” (and pay penalties if you’re under 59½)

The SEP IRA is fine if you’re making $300,000+ annually and maxing out the $69,000 cap regardless of which vehicle you use. But for most freelancers? It’s leaving massive tax savings on the table.

The Solo 401(k): The Ferrari (More Power, Same Cost)

The Solo 401(k)—also called an Individual 401(k) or One-Participant 401(k)—is what happens when you take the traditional 401(k) your corporate friends have and adapt it for self-employed people.

Here’s the secret weapon: You contribute as both the employee AND the employer. This dual-contribution structure is what unlocks dramatically higher limits compared to a SEP.

How a Solo 401(k) Works.

Your contributions split into two buckets:

1. Employee Deferrals (Your Personal Contributions):

- You can contribute 100% of your first $23,500 in earnings (2026 limit)

- If you’re 50+, add another $7,500 catch-up contribution ($31,000 total)

- These can be traditional (pre-tax) OR Roth (post-tax)

2. Employer Profit-Sharing (Your Business Contributions):

- You contribute up to 25% of your net self-employment income

- This stacks on top of your employee deferrals

- Always pre-tax (no Roth option for this portion)

Combined maximum in 2026: $69,000 (or $76,500 if you’re 50+)

The Math That Changes Everything

Remember our $100,000 freelancer from earlier? With a SEP, they maxed out at $23,234. Now watch what happens with a Solo 401(k):

Employee deferral: $23,500 (100% of the first $23,500 you earned)

Employer contribution: $92,935 (net income) × 0.25 = $23,234

Total contribution: $46,734

That’s $23,500 more than the SEP allowed—money you’re sheltering from a 24-32% federal tax bracket. At a 28% effective rate, that’s $6,580 in tax savings in Year One alone. Compound that over 20 years, and we’re talking about a six-figure difference in retirement wealth.

Solo 401(k) Pros

- Massively higher contributions for incomes under $200K: The employee deferral lets you max out faster

- Roth contributions allowed: Pay taxes now, grow tax-free forever (huge for people expecting higher income later)

- Loan provision: Borrow up to 50% of your balance (max $50,000) without penalties or taxes—essentially a zero-interest loan from yourself

- Catch-up contributions: Age 50+ gets an extra $7,500/year

- Backdoor Roth IRA still possible: Unlike SEPs, Solo 401(k)s don’t trigger the pro-rata rule that complicates backdoor Roth conversions

- More investment options: Many providers let you invest in real estate, private equity, or crypto through self-directed Solo 401(k)s

Solo 401(k) Cons

- Slightly more setup work: You’ll fill out a plan document (most brokers provide templates)

- Form 5500-EZ filing: Once your balance hits $250,000, you file this one-page form annually (takes 15 minutes)

- Becomes complicated with employees: If you hire W-2 employees who work 1,000+ hours/year, you must convert to a full 401(k) plan (expensive)

- Higher administrative scrutiny: The IRS watches 401(k)s more closely than SEPs (though if you’re following the rules, this is irrelevant)

The “complexity” argument against Solo 401(k)s is wildly overblown. Yes, there’s a form to file once you cross $250,000—but if you’re contributing aggressively, that’s 4-6 years away. And Form 5500-EZ is literally one page with basic info about your account balance. It’s not a tax return.

The Roth Factor: Tax-Free Growth You Can’t Get with a SEP.

This is where Solo 401(k)s separate themselves from the pack.

With a SEP IRA, every dollar you contribute is pre-tax. You get the deduction today, but you’ll pay ordinary income tax on every withdrawal in retirement—potentially at higher rates if Congress raises taxes or your income increases.

With a Solo 401(k), you can split your employee deferrals between:

- Traditional (pre-tax): Lowers your tax bill now

- Roth (post-tax): You pay taxes upfront, but the money grows tax-free forever

Why This Matters for Freelancers

Most solopreneurs experience income volatility. You might make $80,000 one year and $180,000 the next. This creates a strategic opportunity:

In low-income years: Contribute to Roth (your tax bracket is lower, so paying taxes now is cheap)

In high-income years: Contribute traditional pre-tax (maximize deductions when your bracket is highest)

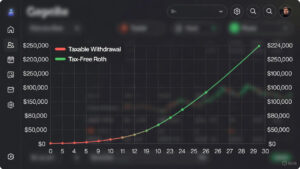

Let’s say you’re 35 years old and contribute $23,500 to a Roth Solo 401(k). Assuming 7% average annual returns, that money grows to $224,000 by age 65—and you’ll pay zero taxes on withdrawals. None. Not one cent.

With a SEP, that same $23,500 might grow to $224,000, but you’ll owe taxes on every dollar. At a 24% tax rate in retirement, you’re handing the IRS $53,760. With Roth, you keep it all.

The kicker: You can’t do this with a SEP. No Roth option exists. You’re locked into pre-tax contributions, meaning you’re betting that your tax rate in retirement will be lower than today. Given rising national debt and potential tax reform, that’s a risky bet.

Math Case Study: Sarah the Freelance Designer

Let’s make this concrete with a real-world scenario.

Sarah is a 38-year-old freelance graphic designer. She earned $80,000 in net profit in 2026 (after business expenses). She’s in the 22% federal tax bracket and wants to minimize her tax bill while building retirement savings.

Scenario A: Sarah Opens a SEP IRA

Her net self-employment income (after deducting half of self-employment tax): $74,840

Maximum SEP contribution: $74,840 × 0.25 = $18,710

Tax savings: $18,710 × 22% = $4,116

Result: Sarah lowers her taxable income by $18,710 and saves $4,116 on her tax bill. Not bad.

Scenario B: Sarah Opens a Solo 401(k)

Employee deferral: $23,500 (she can afford to max this out)

Employer contribution: $74,840 × 0.25 = $18,710

Total contribution: $23,500 + $18,710 = $42,210

Tax savings: $42,210 × 22% = $9,286

Result: Sarah shelters $42,210 from taxes and saves $9,286 on her tax bill.

The Gap: $23,500 More Saved, $5,170 More in Tax Savings

By choosing a Solo 401(k) instead of a SEP, Sarah:

- Contributes $23,500 more to retirement (125% increase)

- Saves an additional $5,170 in taxes in Year One alone

- Unlocks Roth options (she decides to split: $15,000 Roth, $8,500 traditional)

- Can borrow from the account if she hits financial trouble (SEP doesn’t allow this)

Over 25 years (assuming 7% returns), that extra $23,500 compounds to $127,000. That’s the cost of choosing a SEP when a Solo 401(k) was available.

The Paperwork Myth: Debunked

The #1 reason accountants push SEPs over Solo 401(k)s? “Less paperwork.”

Let’s address this head-on.

What You Actually File with a Solo 401(k)

Year 1-4 (Balance under $250,000): Nothing. Zero forms. You open the account, contribute, and file your regular tax return (where you deduct your contributions). That’s it.

Year 5+ (Balance over $250,000): You file Form 5500-EZ annually. This is a one-page form that asks:

- Your name and business info

- Your account balance on the last day of the year

- Checkbox questions about plan compliance

Time required: 10-15 minutes. Most tax software (TurboTax, FreeTaxUSA) walks you through it. Or your accountant files it for $50-100.

That’s the “complexity” everyone fears. A single form that you won’t even encounter until you’ve accumulated a quarter-million dollars in retirement savings.

Compare that to the $127,000 Sarah left on the table by avoiding the Solo 401(k). Would you file a one-page form annually to keep an extra $127,000? Of course you would.

The Broker Comparison: Where to Open Your Account

Not all Solo 401(k) providers are created equal. Here’s the breakdown:

Fidelity (Best Overall for Solo 401(k))

Pros:

- No account fees, no transaction fees on stock/ETF trades

- Excellent Roth Solo 401(k) support

- Easy online setup (plan document pre-filled)

- Can invest in nearly any asset (stocks, bonds, mutual funds, ETFs)

- Loan provision available (borrow from yourself)

Cons:

- Customer service can be slow during tax season

- Roth conversions within the account aren’t allowed (you’d need to roll to a Roth IRA first)

Best for: Freelancers who want Roth options, low fees, and straightforward investing.

Vanguard (Solid, But Rigid)

Pros:

- Rock-bottom expense ratios on index funds

- Rock-solid reputation and stability

- Solo 401(k) option available

Cons:

- Doesn’t support Roth contributions in their Solo 401(k) (this is a dealbreaker for many)

- Limited investment options (mostly Vanguard funds)

- More paperwork required upfront

Best for: Passive index investors who don’t care about Roth and want the lowest possible fund fees.

Charles Schwab (The Middle Ground).

Pros:

- No account fees

- Roth Solo 401(k) supported

- Strong customer service

- Wide investment options

Cons:

- Setup requires mailing physical documents (slower than Fidelity’s digital process)

- Interface feels clunkier than Fidelity

Best for: People who already bank with Schwab and want everything under one roof.

E*TRADE (For Self-Directed Investors)

Pros:

- Self-directed Solo 401(k) option (invest in real estate, crypto, private equity)

- Loan provision available

- Roth supported

Cons:

- $25 quarterly fee ($100/year) for self-directed accounts

- More complex setup

- Requires deeper understanding of investment rules

Best for: Advanced investors who want to hold alternative assets inside their 401(k).

My recommendation: Fidelity for 90% of freelancers. Free, simple, Roth-enabled, and loan-ready. Open it, set up automatic monthly contributions, and forget about it.

When to Pick a SEP IRA Instead

I’ve spent 2,000 words explaining why Solo 401(k)s dominate. But there are three scenarios where a SEP makes sense:

1. You Have W-2 Employees (or Plan to Hire Soon)

If you have employees who work 1,000+ hours/year, a Solo 401(k) won’t work (it’s only for solo businesses). SEPs remain functional—you just have to contribute the same percentage to employees that you contribute for yourself (expensive, but legal).

2. You’re Earning $300,000+ and Maxing Out Anyway

If you’re netting $300K+, you’ll hit the $69,000 contribution cap with either vehicle. At that point, the SEP’s simplicity (no Form 5500-EZ) might appeal to you. Though honestly, the Roth option alone still makes the Solo 401(k) more valuable.

3. You’re Genuinely Overwhelmed by Paperwork

If you’re a technophobe who’s terrified of forms and has no accountant, fine—open a SEP. But understand you’re paying a steep premium (tens of thousands in lost savings) for simplicity.

For everyone else? Solo 401(k) wins.

The Loan Feature: Your Emergency Fund Inside Your Retirement.

Here’s a Solo 401(k) benefit no one talks about: you can borrow from yourself.

With a SEP IRA, if you need cash urgently, your only option is an early withdrawal (taxed as income + 10% penalty). You’re losing 30-40% of your money.

With a Solo 401(k), you can take a 401(k) loan:

- Borrow up to 50% of your vested balance (max $50,000)

- Pay yourself back with interest (the interest goes back to YOUR account)

- No taxes, no penalties if you repay on schedule

- Repayment period: typically 5 years (15 years if used for a home purchase)

Example: Your Solo 401(k) has $80,000. Your car dies and you need $20,000 immediately. You take a 401(k) loan at 5% interest. Over 5 years, you pay yourself back $377/month. That $377 (including the interest) goes back into your retirement account.

Compare that to:

- A bank loan at 10-18% interest (you lose thousands to the bank)

- Credit card debt at 25% APR (financial suicide)

- Early withdrawal from a SEP IRA (30-40% lost to taxes and penalties)

The 401(k) loan is a zero-sum game—you’re borrowing from future you and paying future you back with interest.

It’s not ideal (you’re missing out on investment growth during the loan period), but it’s a legitimate emergency option that SEPs don’t offer.

The Verdict: Solo 401(k) for 90% of Solopreneurs.

Let’s cut through the noise.

Choose a Solo 401(k) if:

- You’re earning $80,000 to $250,000/year (the sweet spot where employee deferrals make the biggest difference)

- You want Roth contributions (tax-free growth)

- You want flexibility (loans, higher limits, catch-up contributions)

- You’re willing to spend 15 minutes annually on Form 5500-EZ once you hit $250K

- You have zero employees and don’t plan to hire W-2 staff soon

This is the vast majority of solopreneurs. Freelance writers, designers, consultants, coaches, developers—Solo 401(k) is your weapon.

Choose a SEP IRA if:

- You have W-2 employees (or will soon)

- You’re netting $300,000+ and maxing contributions either way

- You’re genuinely allergic to paperwork and willing to pay for simplicity

- You don’t care about Roth, loans, or catch-up contributions

Choose neither if:

- You’re earning under $50,000/year (build an emergency fund first, max out a regular Roth IRA—$7,000 limit—before worrying about these)

Final Thoughts: The Cost of Inertia.

The biggest retirement mistake isn’t picking the wrong account. It’s picking no account because you got paralyzed by the decision.

If you’re reading this in March 2026 and haven’t opened a retirement account for 2025 yet, do this today:

- Go to Fidelity.com

- Click “Open a Solo 401(k)”

- Fill out the 10-minute application

- Contribute before the April tax deadline (you can fund 2025 contributions until April 15, 2026)

Even if you only contribute $10,000 this year, that’s $10,000 you’re sheltering from taxes and investing for your future. Compounded over 30 years at 7%, that’s $76,000.

The difference between a SEP and a Solo 401(k) isn’t academic. It’s tens of thousands—potentially hundreds of thousands—of dollars in your pocket versus the IRS’s pocket.

Your accountant might not explain this. Brokers don’t advertise it loudly (SEPs are simpler for them to manage). But now you know.

Choose the Ferrari. Your 65-year-old self will thank you.

Read Also: TurboTax vs. FreeTaxUSA (2026): Is the “Free” Option Safe for Freelancers?